arizona charitable tax credits 2020

High Holiday Food Drive. Consider the example of a single taxpayer who makes a 400 donation to an eligible Qualifying Charitable Organization and a second 500 gift to a.

Arizona Charitable Tax Credit For Southern Arizona Home Facebook

The Arizona Charitable Tax Credit gives taxpayers more choice in how their tax dollars are allocated.

. Ad signNow allows users to edit sign fill and share all type of documents online. Public Schools Form 322. 2022 Brighter Tomorrow Virtual Event.

For the Arizona Credit for Contributions to Charitable Organizations Form 321 only Cash Donations qualify. Say Thanks by clicking the thumb icon in a post. Donate to a qualified charitable organization QCO or QFCO such as a 501 c 3 organization like Gompers.

Complete the AZ Tax Credits forms as normal for any Qualifying donations. There are approximately 14000 children in the foster care program in Arizona. What is the Arizona Charitable Tax Credit.

Funding of QFCOs provide a wide. If you earned 40000 and donated 400 to FSL and 500 to a foster care organization a tax deduction policy means your income is considered to be 39100. Marys Food Bank is a 501 c 3 organization that qualifies for.

Effective in 2018 the Arizona Department of Revenue has assigned a five 5 digit code number to identify each Qualifying Charitable Organization and Qualifying Foster Care Charitable Organization for Arizona tax credit purposes on Form 321 and Form 352 which is included with the Arizona income tax return. Marys 2019 tax is 250. A credit of up to 400 for married filing joint and 200 for all other filers is available for payment of fees to an Arizona public school or charter school for extracurricular activities or character education.

This change is in effect until June 30 2022. Here is a great example from the Arizona Department of Revenues website. There is no carry forward for this credit.

Content updated daily for az charitable tax credit. The lists of the certified charities on azdorgov displays the certified charities for that year. Rules for Claiming Arizona Tax Credits for Donations.

Arizona Charitable Tax Credit. Contributions to certain charities or public schools will not qualify for a federal charitable contribution deduction. Mark the post that answers your question by clicking on Mark as Best Answer.

Make a Donation up to 800 with the Arizona Charitable Tax Credit. Qualified Foster Care Organization. 10 rows Arizona Small Business Income Tax Highlights.

Click the link for detailed info at the Arizona Dept. There are four steps to document your donation and claim your tax credits. 1745 S Alma School Road 145 Mesa AZ 85210 480 963-3634 22280 Barn Yard Equine 13902 E Morgan.

For donations made from January 1 2021 to May 17 2021 - use the 2021 list. For all of them you have until April 15 2021 or until the date you file your return if you do so early to donate for the 2020 tax year. 2020 Arizona Tax Credits Easy Reference Guide For Arizona State Residents only Arizona individual taxpayers have the opportunity to redirect state income tax to a variety of Arizona charities through the use of Arizona tax credit contributions.

This tax credit is available for cash contributions and is claimed on Arizona Form 322. Complete the relevant tax form to claim one or more credits. AASK is a 501c3 non-profit tax ID 86-0611935.

Any Arizona taxpayer is eligible to claim this credit and it does not. Your dollar-for-dollar tax credit donation to a Qualified Charitable Organization will support organizations assisting low income children individuals and families. Visit the Arizona Department of Revenue website for more information about state income tax credits for charitable contributions in Arizona or call us at 602-930-4452.

Unfortunately the somewhat new tax laws no longer allow Arizona taxpayers to deduct Arizona tax credits as charitable contributions on Federal Schedule A. Making a difference in your community doesnt have to be. When you invest 1500 in Parent Aid you provide weekly in-home support to a family for a full year which.

Name of Organization Address Phone QCO Code Qualifying organizations for cash donations made between January 1 2020 and December 31 2020 20750 Backyard Healthcare Project 204 E. Your investment of 800 supports community families growth in communication child development discipline and self-care by providing an entire class series. Mary can apply 250 of the credit to her 2019 tax liability and carryover 150 of the unused 400 credit to.

Marys Food Bank you can receive a dollar-for-dollar tax credit on your AZ state return up to 400 for individuals and 800 for those filing jointly. With a 3 tax rate you would owe 1173 in taxes. Donations made between January 1 2021 and April 15 2021 can be claimed as a credit on either your 2020 or 2021 state tax return.

Tax Planning with Arizona Credits. There are separate lists for QCOs and. Arizona Charitable Tax Credit Claim AZ Tax Credit for 2021 by 418.

Arizona offers dollar for dollar tax credits for contributions made to Qualifying Charitable Organizations and Qualifying Foster Care Organizations but there are limits to the amount of contributions that you can receive a credit for. Create Legally Binding Electronic Signatures on Any Device. Through the Arizona Charitable Tax Credit you can receive a credit on your Arizona tax liability up to 400 individually or 800 for couples filing jointly.

There are four major tax credits that you can use to offset certain charitable donations in Arizona. Arizonas Children Association Qualifies for the Arizona Charitable Tax Credit of 400 for individuals and 800 for couples. Maintain a receipt of your gift from the charity in order to provide a copy with your tax return.

Our Tax ID is 86-0096772 and Qualifying. Arizona Dept of Veterans Affairs will provide you with a receipt that will let you know if your donation qualifies for the credit. When you make a donation to St.

For donations made in 2020 - use the 2020 list. The maximum allowable credit for contributions to public schools is 400 for married filing jointly filers or 200 for single married filing separately and heads of household filers. In Arizona instead of reducing the amount of taxable income the state charitable tax credit policy reduces your overall taxes.

For 2019 Mary is allowed a maximum credit of 400. Taxes can be complicated. SCNM Sage Foundation is a Qualified Charitable Organization QCO eligible for the Arizona Charitable Tax Credit.

You can provide the in-home safety education module to a family for just 400. Contributions to QFCOs made between January 1 2021 and April 15 2021 can be claimed as a credit on your 2020 or 2021 Arizona tax return. Fort Lowell Rd Tucson AZ 85705 520 867-8004 20174 Baio Institute Inc.

A taxpayer can only claim a tax credit for donations made to certified charities. During 2019 Mary a single person gave 600 to a qualified charity. The credit will be available for 2020 donations and more.

Check out some resources to help you get the guidance and support you need. ARIZONA CHARITABLE DONATIONS TAX CREDITS. United Way 0023 QFCO 10026.

Ad This is the newest place to search delivering top results from across the web. When you donate to Valley of the Sun United Way through the Arizona Charitable Tax Credit you will get your donation amount back in your state taxes up to 800 either as a deduction to your liability or an increase to your refund no itemizing necessary.

Qualified Charitable Organizations Az Tax Credit Funds

Qualified Charitable Organizations Az Tax Credit Funds

List Of 6 Arizona Tax Credits Christian Family Care

Qualified Charitable Organizations Az Tax Credit Funds

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

With 35 0 Continuing Education Credits Set To Be Available Avaatyourfingertips Is Continuing Education Credits Continuing Education Md Anderson Cancer Center

Arizona Charitable Tax Credits Parent Aid

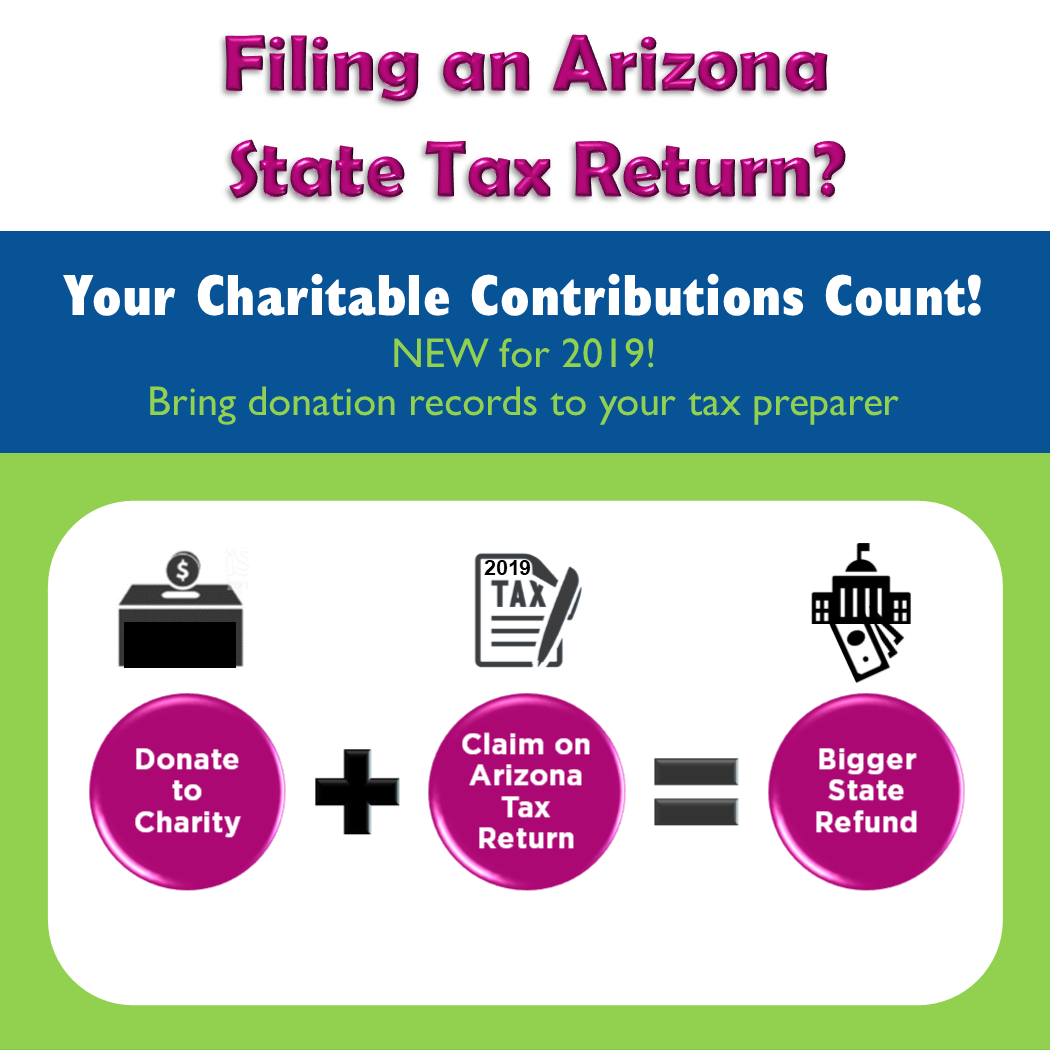

Charitable Contributions Count In Arizona Tempe Community Council

Breakdown Of 2020 Az Tax Credits Sterling Accounting Tax Llc

Arizona S 2020 Charitable Tax Credits Henry Horne

Give To Nac An Arizona Qualifying Charitable Organization Native American Connections

Arizona Charity Donation Tax Credit Guide Give Local Keep Local

The 2022 Definitive Guide To The Arizona Charitable Tax Credit Phoenix Children S

Arizona Tax Credits Az Tax Credits 2020 Price Kong

![]()

Qualified Charitable Organizations Az Tax Credit Funds

Taxpayers Have Until May 17 To Donate To Charities Stos And Public Schools For 2020 Tax Year Smis

Tax Credits For Donations To Area Groups And Schools Local News Paysonroundup Com